What Transcript Should Taxpayers Ask For? The IRS’s Get Transcript page is available in five languages, and the online application is also available in Spanish. With the difficulty reaching the IRS by phone or correspondence during the last two filing seasons, using the portal or online account may be more efficient than calling the IRS due to long wait times, the potential inability to speak with an available customer service representative, or the length of time for the IRS to respond to a mailed transcript request.

Taxpayers ( and tax professionals with a properly executed Form 2848, Power of Attorney, or Form 8821, Tax Information Authorization) can request a transcript online through the IRS’s Get Transcript Online portal or their online account by mail or by calling the IRS’s automated phone transcript service at 80. Taxpayers may be able to get answers to their questions quickly and efficiently by requesting and reviewing their transcript – that is, if they can decipher them.

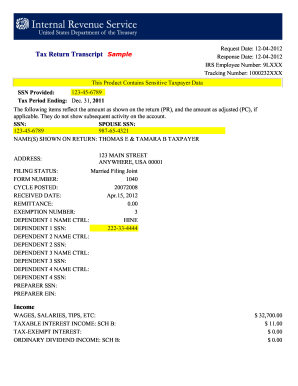

A requested transcript may provide information regarding the date the IRS received a return payment history including refunds, transfers between tax years and overpayment credits balance due amounts interest assessed refundable credits allowed basic examination information and Forms W-2 or 1099 information. The IRS maintains records for all taxpayers – individuals, businesses, and other entities – and provides five types of transcripts. Transcripts can also be useful to taxpayers when preparing and filing tax returns by verifying estimated tax payments, Advance Child Tax Credits, Economic Income Payments/stimulus payments, and/or an overpayment from a prior year return. Transcripts are often used to validate income and tax filing status for mortgage applications, student loans, social services, and small business loan applications and for responding to an IRS notice, filing an amended return, or obtaining a lien release. Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge.

0 kommentar(er)

0 kommentar(er)